Entities

View all entitiesIncident Stats

CSETv0 Taxonomy Classifications

Taxonomy DetailsPhysical System

Software only

Level of Autonomy

Medium

Nature of End User

Amateur

Public Sector Deployment

No

Data Inputs

Stock Price, trading volume

Laws Implicated

Fraud

GMF Taxonomy Classifications

Taxonomy DetailsPotential AI Technology Snippets

(Snippet Text: The May 6, 2010, Flash Crash,[1][2] also known as the Crash of 2:45, the 2010 Flash Crash or simply the Flash Crash, was a United States trillion-dollar[3] stock market crash, which started at 2:32 p.m. EDT and lasted for approximately 36 minutes., Related Classifications: Regression), (Snippet Text: On May 6, 2010, the primary market makers in the stock market just stopped automatically taking the other side of everyone else's trades. , Related Classifications: Regression)

Potential AI Technology Classification Discussion

Regression: This is valid only if prices were automatically suggested by the software: extreme / over-optimized solutions proposed by the price system.

CSETv1 Taxonomy Classifications

Taxonomy DetailsIncident Number

28

CSETv1_Annotator-1 Taxonomy Classifications

Taxonomy DetailsIncident Number

28

CSETv1_Annotator-2 Taxonomy Classifications

Taxonomy DetailsIncident Number

28

Special Interest Intangible Harm

no

Date of Incident Year

2010

Date of Incident Month

05

Date of Incident Day

06

Estimated Date

No

Incident Reports

Reports Timeline

- View the original report at its source

- View the report at the Internet Archive

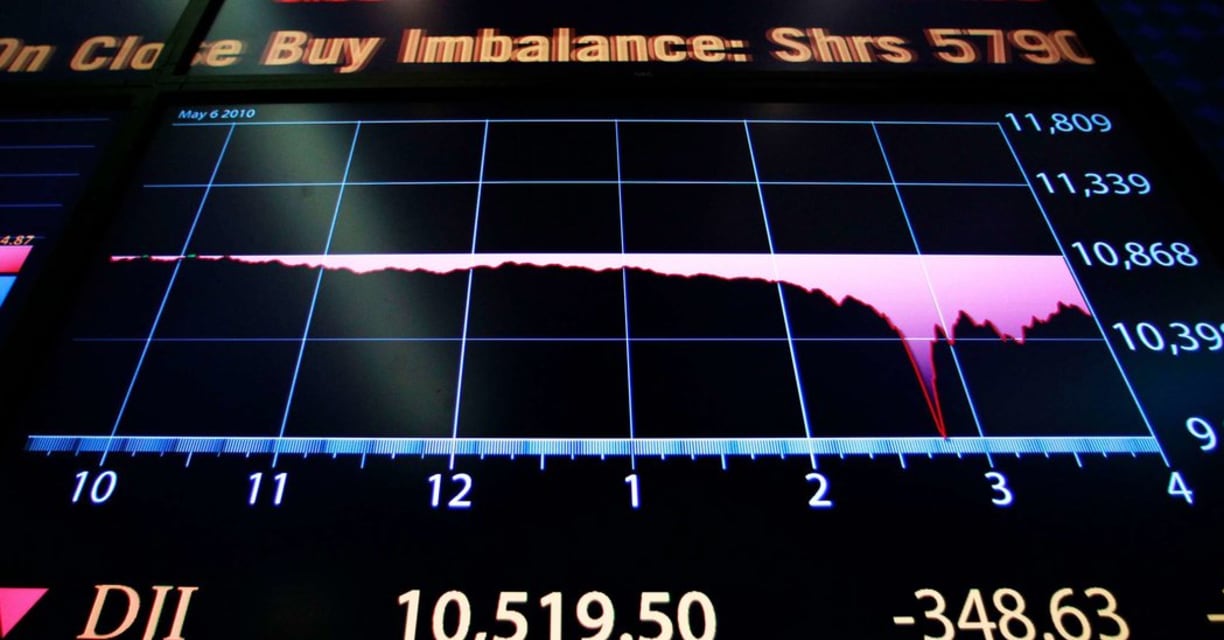

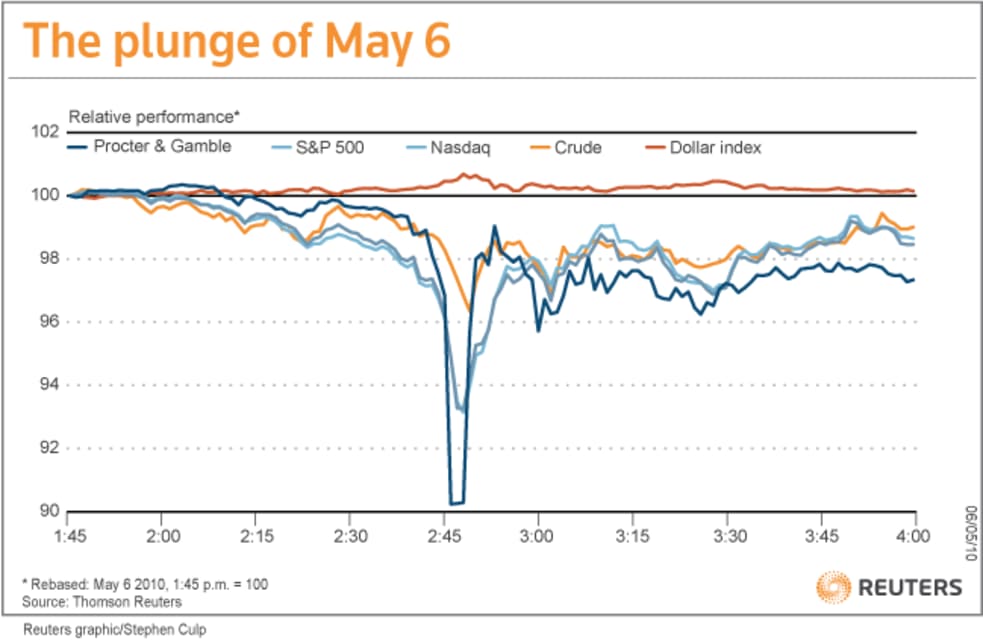

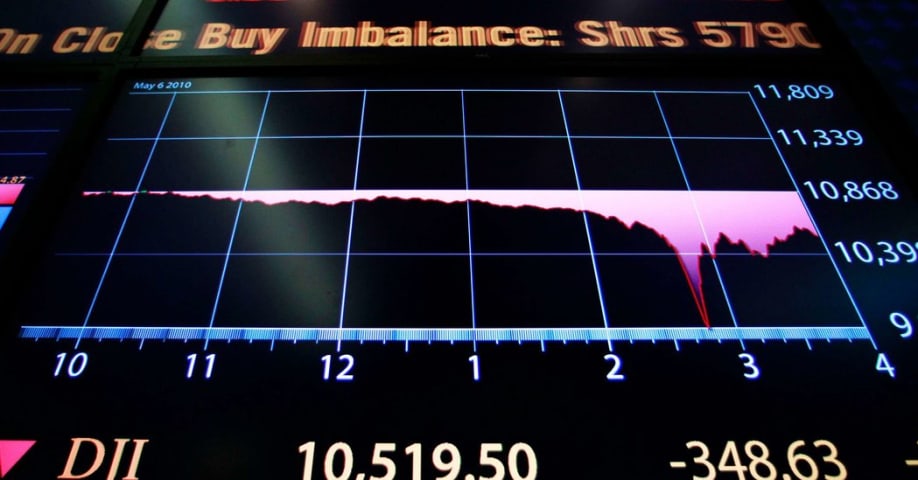

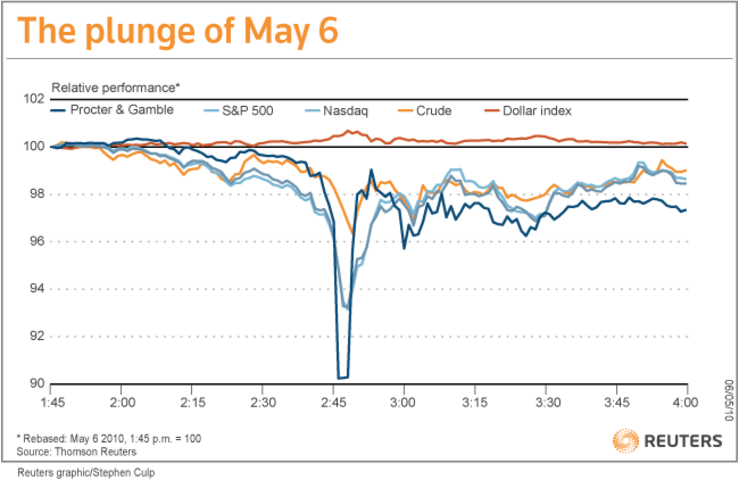

The DJIA on May 6, 2010 (11:00 AM - 4:00 PM EDT)

The May 6, 2010, Flash Crash,[1][2] also known as the Crash of 2:45, the 2010 Flash Crash or simply the Flash Crash, was a United States trillion-dollar[3] stock market crash, which started a…

- View the original report at its source

- View the report at the Internet Archive

Fragmentation among stock exchanges . In 1987, when we had the crash that took 22.6% off the Dow, trading execution was much slower and more concentrated. Back then, 90% of stock trading occurred on the New York Stock Exchange (NYSE). In 20…

- View the original report at its source

- View the report at the Internet Archive

On May 6, 2010, the prices of many U.S.-based equity products experienced an extraordinarily rapid decline and recovery. That afternoon, major equity indices in both the futures and securities markets, each already down over 4% from their p…

- View the original report at its source

- View the report at the Internet Archive

Here's the basic outline of what caused the biggest one-day point decline in the history of the Dow Jones Industrial Average. On May 6, 2010, the primary market makers in the stock market just stopped automatically taking the other side of …

- View the original report at its source

- View the report at the Internet Archive

In just 20 minutes the New York Stock Exchange had witnessed it’s biggest stock plunge in decades, all traced to one gargantuan sell order

It was 6 May 2010. In the UK it was general election day, in the US,Wall Street was gripped by mounti…

- View the original report at its source

- View the report at the Internet Archive

The Dow Jones Industrial Average slumped nearly 1,000 points in a matter of minutes in the flash crash of 2010, sending traders into a panic and inciting scrutiny of the U.S. equities markets that's still being felt four years later.

The Ma…

- View the original report at its source

- View the report at the Internet Archive

Hey look, they caught the guy who caused the flash crash of 2010! His name is Navinder Singh Sarao, and he lives in London and in 2009 he asked someone to help him build a spoofing robot:

On or about June 12, 2009, SARAO sent an email to a …

- View the original report at its source

- View the report at the Internet Archive

On Thursday May 6, 2010, the US stock market collapsed , wiping billions off some of the world's biggest companies.

The Dow Jones Industrial Average, already down more than 4pc from the previous day's close, plummeted a further 5pc to 6pc i…

- View the original report at its source

- View the report at the Internet Archive

Fox Business Was one trader responsible for the flash crash?

WASHINGTON (MarketWatch) — The 2010 “flash crash” — in which the Dow industrials sank by around 1,000 points before quickly recovering — has been debated for years. But on Tuesday…

- View the original report at its source

- View the report at the Internet Archive

Jessica Morris

The "flash crash" caused the Dow to fall as much as nine per cent (Source: Getty)

British trader Navinder Singh Sarao has been arrested, charged and is facing extradition to the United States over his role in the "flash crash…

- View the original report at its source

- View the report at the Internet Archive

Five years ago, the global financial system was rocked by the “flash crash,” 15 minutes of chaos that shook the world’s biggest markets and prompted investors both big and small to question how such a vital part of the economy could be brou…

- View the original report at its source

- View the report at the Internet Archive

An Indian-origin futures trader has been arrested in the U.K. and faces extradition to the U.S. for his alleged role in the May 2010 “flash crash” which wiped billions of dollars off the value of U.S. shares in minutes.

Navinder Singh Sarao…

- View the original report at its source

- View the report at the Internet Archive

WASHINGTON (Reuters) - A high-frequency trader was arrested in London over his alleged role in the May 2010 “flash crash” that briefly wiped out nearly $1 trillion in market value, the first time authorities have blamed manipulation for the…

- View the original report at its source

- View the report at the Internet Archive

The mystery over the May 6, 2010 Flash Crash took a turn on Tuesday when the Department of Justice said it arrested Navinder Singh Sarao, a little known trader working from his home near London's Heathrow Airport, for allegedly playing a ke…

- View the original report at its source

- View the report at the Internet Archive

Nearly five years after the so-called “flash crash”—when the market dropped hundreds of points in the span of a few minutes on May 6, 2010—authorities have arrested a trader that they believe helped cause the swoon.

But the alleged culprit,…

- View the original report at its source

- View the report at the Internet Archive

At about 2:30pm on May 6, 2010, an asset management firm began executing a series of orders on the Chicago Mercantile Exchange. Located in Overland Park, Kansas, Waddell & Reed was (and is) one of the oldest mutual fund companies in America…

- View the original report at its source

- View the report at the Internet Archive

CLOSE The cause of the 2010 Flash Crash keeps changing, and the latest who-done-it conclusion has met with skepticism on Wall Street. Jason Allen

Investors question how a small-fry trader moves markets, and why regulators let it go on so lo…

- View the original report at its source

- View the report at the Internet Archive

From a modest stucco house in suburban west London, where jetliners roar overhead on their approach to Heathrow Airport, a small-time trader was about to play a hand in one of the most harrowing moments in Wall Street history.Navinder Singh…

- View the original report at its source

- View the report at the Internet Archive

What was the Flash Crash?

One of the most scary and bizarre days in Wall Street’s history. On 6 May 2010, the Dow Jones Industrial Average Index plummeted by 6 per cent in a matter of minutes - an unprecedented single-day fall. The shares o…

- View the original report at its source

- View the report at the Internet Archive

Whistleblower Program

The past week we have made markets safer by arresting the dangerous flash crash villain who was a threat to national security and the health of the entire financial market system. Like I always say when in doubt follow…

- View the original report at its source

- View the report at the Internet Archive

The flash crash has proven one of the most mysterious market events in recent history. Many observers still believe the event hasn't been fully investigated. Their view is fueled in part by new allegations that a London trader's manipulativ…

- View the original report at its source

- View the report at the Internet Archive

- pencer Platt/Getty Images

Listen To The Story Marketplace Embed Code

May 6, 2015, marks the five-year anniversary of the so-called ‘flash crash’ on the New York Stock Exchange. That day, the Dow Jones Industrial Average plummeted more tha…

- View the original report at its source

- View the report at the Internet Archive

Reuters The search for causation over the May, 2010 "flash crash," a one hour near 1,000 point loss and recovery on the Dow Jones Industrial Average, is a complex topic but one important to accurately document.

Such quantitative market mish…

- View the original report at its source

- View the report at the Internet Archive

Image copyright Getty Images Image caption Navinder Sarao, the so-called "flash crash" day trader has been fighting attempts to extradite him to the US

Navinder Sarao, who traded from his parents' home in Hounslow, west London, has been acc…

- View the original report at its source

- View the report at the Internet Archive

In the financial world, high-frequency trading has become the new norm. By using trading algorithms and dedicated tools, stock market players can execute trades in milliseconds. The ultimate goal is to increase profits in a near-automated w…

- View the original report at its source

- View the report at the Internet Archive

What is the 2010 Flash Crash?

The 2010 Flash Crash is the market crash occurred on May 6, 2010. During the 2010 crash, leading US stock indices, including the Dow Jones Industrial AverageDow Jones Industrial Average (DJIA)The Dow Jones Indu…

- View the original report at its source

- View the report at the Internet Archive

On May 6, 2010, at approximately 2:32 pm EST, all three U.S. stock indices–The Dow Jones Industrial Index, S&P 500, and the Nasdaq Composite–underwent a massive plunge and a partial rebound over a 36-minute period.

In just a matter of minut…

- View the original report at its source

- View the report at the Internet Archive

Using intraday data on individual stocks included in the S&P 500 index, we present evidence of herd formation over the duration and aftermath of the Flash Crash on May 6, 2010, while no evidence of herding is observed preceding the event. T…

- View the original report at its source

- View the report at the Internet Archive

Using intraday data on individual stocks included in the S&P 500 index, we present evidence of herd formation over the duration and aftermath of the Flash Crash on May 6, 2010, while no evidence of herding is observed preceding the event. T…

- View the original report at its source

- View the report at the Internet Archive

In California, people fear the “big one” – an earthquake of such magnitude that it could wipe the state off the map. They look nervously at the intense seismic tremors from previous earthquakes and fear it is only a matter of time. The fina…

Variants

Similar Incidents

Did our AI mess up? Flag the unrelated incidents

Poor Performance of Tesla Factory Robots

Security Robot Drowns Itself in a Fountain

Defamation via AutoComplete

Similar Incidents

Did our AI mess up? Flag the unrelated incidents

Poor Performance of Tesla Factory Robots